Production swings and a tighter global balance sheet

Rowan Fessey 16 July 2024

Global agricultural commodity markets came under pressure through June with market participants becoming more comfortable with production prospects ahead of the northern hemisphere harvest along with sluggish global demand.

Black sea wheat production is on the mend according to analysts, with estimated Russian production now pegged between 82 and 84 million metric tonnes (MMT), down from 92MMT last year. This is a sizeable increase from the 78MMT estimate that was being circulated through analyst wires in May which drove the rally through May.

Headers are rolling through southern Russian fields on the border with Georgia where yields have so far surprised to the upside. Russian cash markets responded and have softened as harvest progresses north. There was a brief moment in May where it looked like Russia might lose the crown as the worlds low-cost wheat supplier to the Europeans. However with crop prospects improving and the unofficial export floor price quietly disappearing, Russian exporters have resumed their aggressive offers out to global buyers.

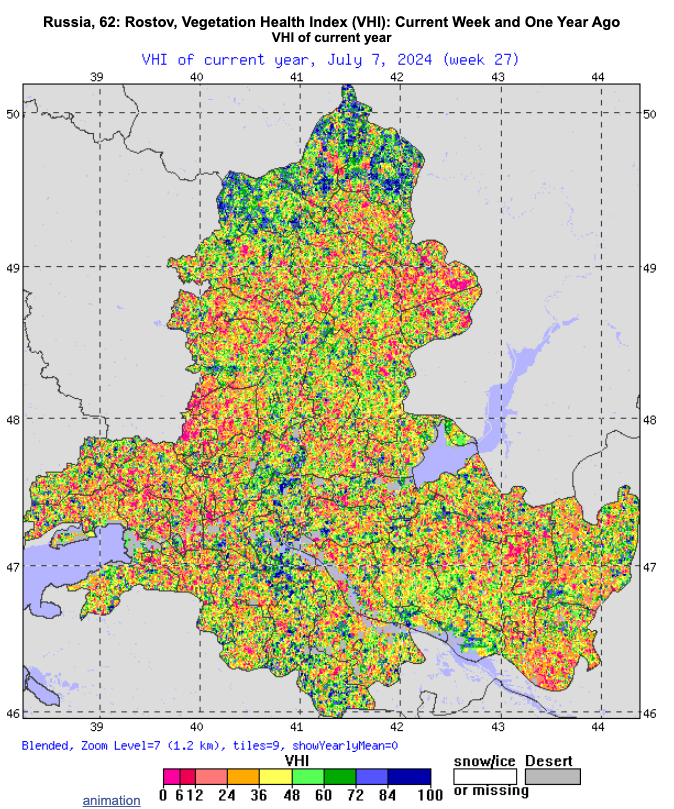

Russian harvest is still in its early stages and is yet to reach the key production areas in the central and southern regions. These regions account for two thirds of production and had a very tough, hot and dry finish. The year on year vegetation health index map below shows the biggest wheat producing Oblast (region) of Rostov, with significant heat vegetation stress in comparison to last year so some surprises could still be in store when the headers get rolling.

Other major wheat producing nations are also having production swings which will shape the global wheat balance sheet for the coming year. French wheat is set to be 15% lower year on year at 29.7MMT. Canadian production looks set to improve to 35MMT up from 32MMT last year, and US production is also improving with what looks like the best US wheat crop since 2019 with the July WASDE coming in at 54.66MMT, up 5.35MMT year on year.

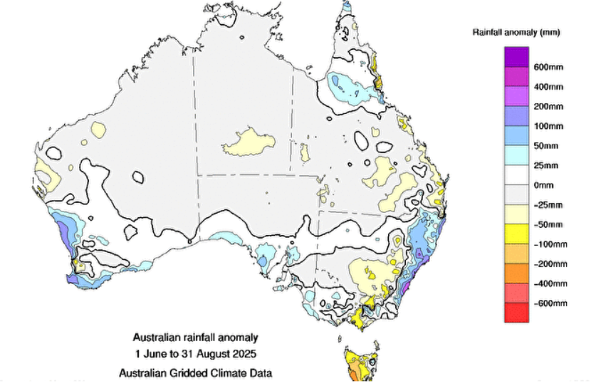

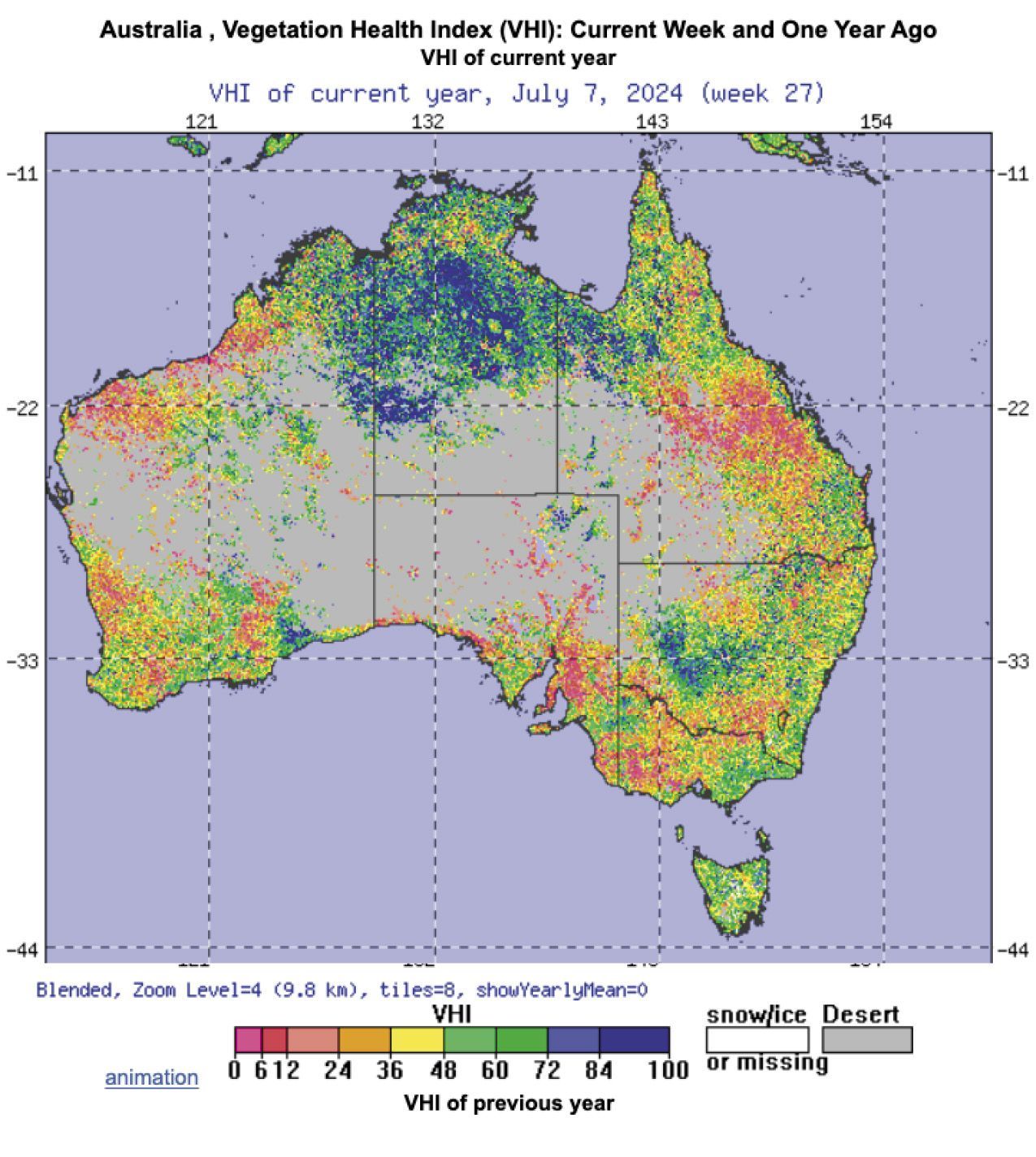

The Australian 2024/25 season is also improving with WA receiving timely rainfall through June and early July to make up for a dry start. SA and parts of VIC are still in need of a break after only receiving patchy showers. NSW is looking in good shape for above average production.

The most significant weight on the wheat market through June has been the prospect of a large corn crop in the US. The acreage report released by the USDA in late June indicated growers had planted 600,000 more hectares than the March report. This was a larger increase than many were expecting. Although this is down on last years plantings it would still be the eighth largest corn area in the last 8 decades and has weighed heavily on markets. In the most recent USDA report this larger US corn production has been offset by increased exports which will actually result in a reduced carry out.

What does it mean for us?

The overall impact of these production swings will result in a tighter global wheat balance sheet for the coming year, with global production increases in the US, Canada and Australia not enough to offset the declines in the Black Sea. The geographical importance of the changes also needs to be acknowledged. The largest production reductions are occurring in the lower cost producing regions, with global exportable surplus shifting slightly to countries with higher cost of production. The anchor that has been cheap Russian grain in the global market may not be as heavy going forward. However, this weight on the market looks like it will be replaced by US corn, with the expected larger production likely to displace wheat in feed rations across the world.

Things to watch

The US corn crop is a long way from in the bin. The crucial pollination period through July can be impacted by excessive heat, excessive moisture and a number of other environmental factors. With an early hurricane season looming in the US we will need to keep an eye on conditions.

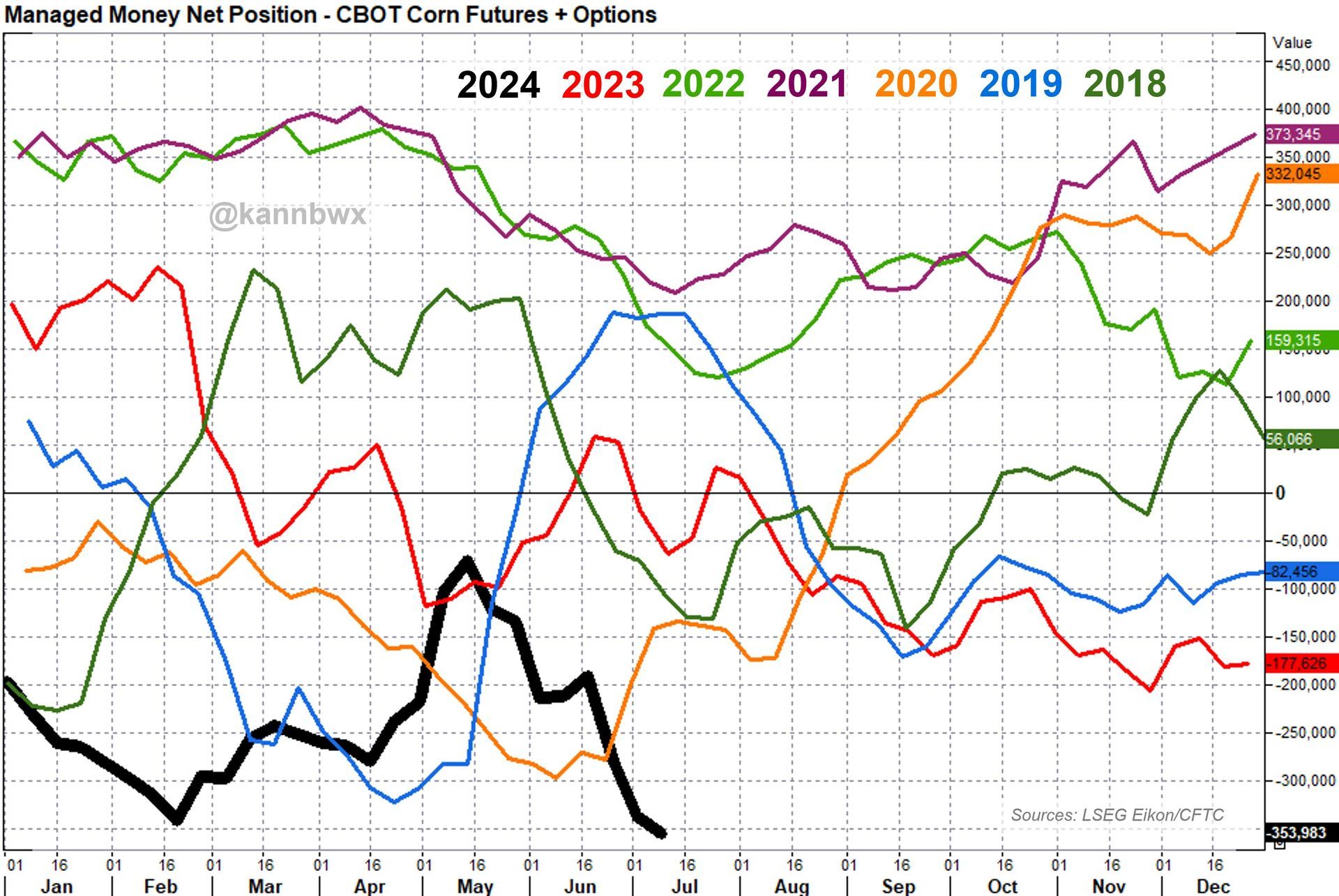

Fund positions also need to be monitored with near record shorts on corn contracts in the US. In the week ending July 2nd 2024, the net short on CBOT corn was increased to 336,000 contracts, up from 278,000 the week prior. Nearing the all time short record of 340,000 contracts in February earlier this year. With most corn contracts now sitting near contract lows, the fund shorts will be wary of any minor production issues and aware that exiting a short of that size in an orderly fashion can be tricky.