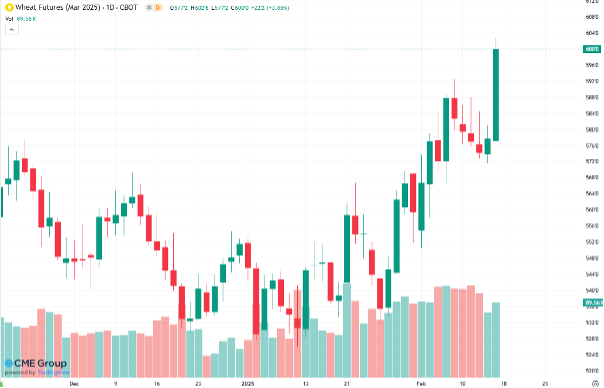

Strong performance from wheat to start 2025

Chris Nikolaou, 18 February 2025

Since the start of the year, global wheat prices have risen. The benchmark contract for Chicago wheat futures is up 16% over the last six weeks. Russian values for 12.5% protein wheat have risen and we are starting to see this flow through to Australia with local values also on the rise. What has driven this improvement in pricing?

Russian Ag

In a world-grain.com article dated January 1st, 2025 they estimated that the Russian winter grain harvest could be the worst in 23 years. They cite ongoing drought over 2024 has being a major catalyst. However, their woes are deeper than weather driven impacts to production.

The war with Ukraine has impacted many parts of the Russian Ag industry. Trade sanctions against Russia and retaliatory against trading partners have limited the ability of Russian famers to access higher quality seed, equipment and machinery from off-shore. Also, the import quotas that did exist were limited to a few companies, leading to price gouging for these inputs.

The world-grain.com article went on to state “the Russian Central Bank’s decision to jack up the key interest rate to 21% during the recent board meeting in October 2024 made commercial loans virtually unaffordable for Russian farmers”. This response to high inflation has led to a situation where Russian purchases of new harvesters and tractors is down significantly as the costs of capital is too high. With declining farm profitability, “farmers cut the use of fertilizers, and plant protection agents and switched to cheaper, lower-quality seeds”.

Finally, the Russian agriculture sector is suffering from a shortage of labour. Rural businesses are competing with employers in the cities at a time when there has been a huge recruitment drive by the armed forces. “The labour shortage is projected to get worse. Each year, the Russian population in the 20-65 age group shrinks by about 1 million”.

Supply and Demand

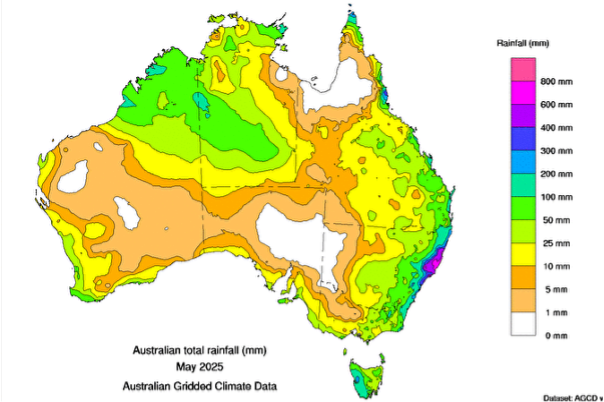

Overall, the southern hemisphere has finished off the harvest season with above average production. The February 2025 World Agricultural Supply and Demand (WASDE) update showed Argentina’s production up by 2MMT year over year to 17.5MMT and Aussie up 6MMT to 32MMT. To a certain degree this has masked the issues plaguing Russia. However, the Russian ag ministry has dramatically lowered the countries wheat export quota. In an article for graincentral.com on December 3rd, 2024, local industry senior manager Peter McMeekin states that “a wheat export quota of 11 million tonnes for the second part of the marketing year 15 February to 30 June 2025 would be down from 29 million tonnes in the same period for 2024” (https://www.graincentral.com/markets/russia-announces-wheat-export-quota/). This bodes very well for Australian producers as global importers will need to shift more of their purchases to Australia.

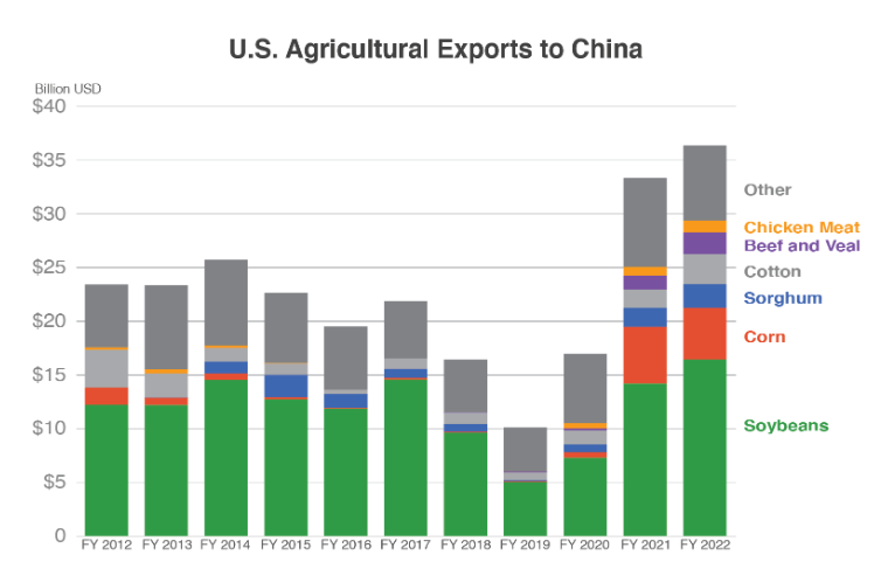

However, the WASDE also decreased Chinese wheat imports to 8MMT which is down from 13.6MMT last season. This is a headwind for global markets. However, it would be very bullish for global wheat pricing if China were to change tact and import higher volumes of wheat. Watch this space.

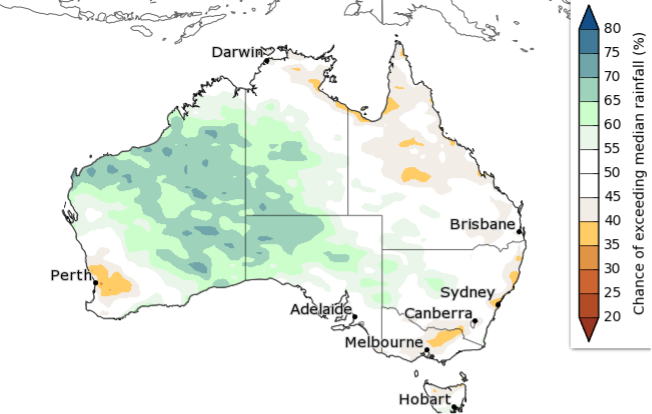

Weather Outlook

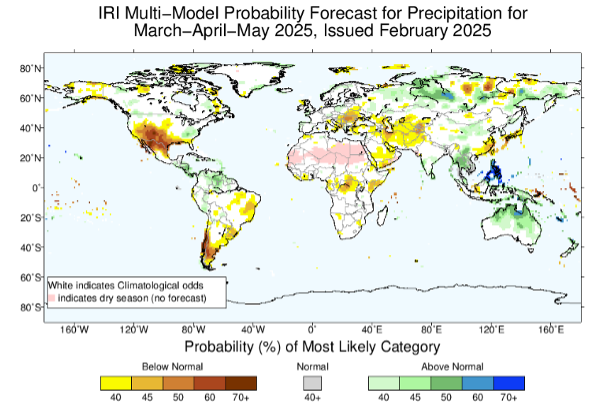

Two of the largest northern hemisphere wheat producers face uncertain outlooks. Russia has an industry falling into disrepair plus ongoing drought through some of its ag regions. Also, the US faces an uncertain weather outlook. Currently, Mexico has experienced an ongoing drought for most of the last two years. There is concern that this could spread north and east into the southern plains during the US spring.

Summary

We have enjoyed a price increase in wheat since the start of the year in spite of larger Aussie and Argentinian harvests. This has been more than offset by reduction of Russian supply for the first half of 2025. Over the next few months, Australia should enjoy a very strong demand which bodes well for local pricing. However, high levels of volatility will remain as the market watches to see how Mother Nature treats North America and the Black Sea production regions this coming year.

If you’re still holding grain from harvest, Advantage Grain’s 4 month structured sales program remains open for transfers. This program sells an equal portion of your grain each month from March until June, returning you the best price average over the period. For further information on Advantage Grain’s 4 month sales program – watch the video below or call the team on 1300 245 586.