Weather, politics and resilience

In spite of volatile politics and challenging weather, Aussie growers are showing they can do more with less.

Chris Nikolaou, 18 March 2025

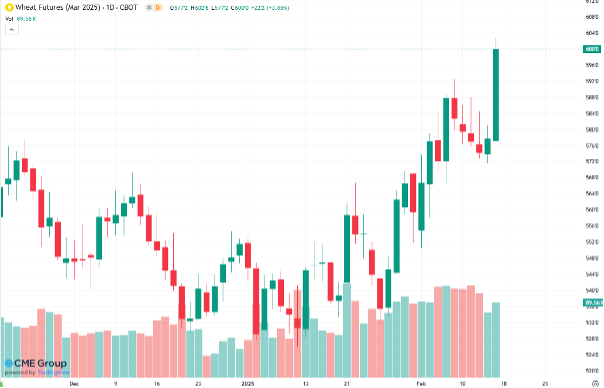

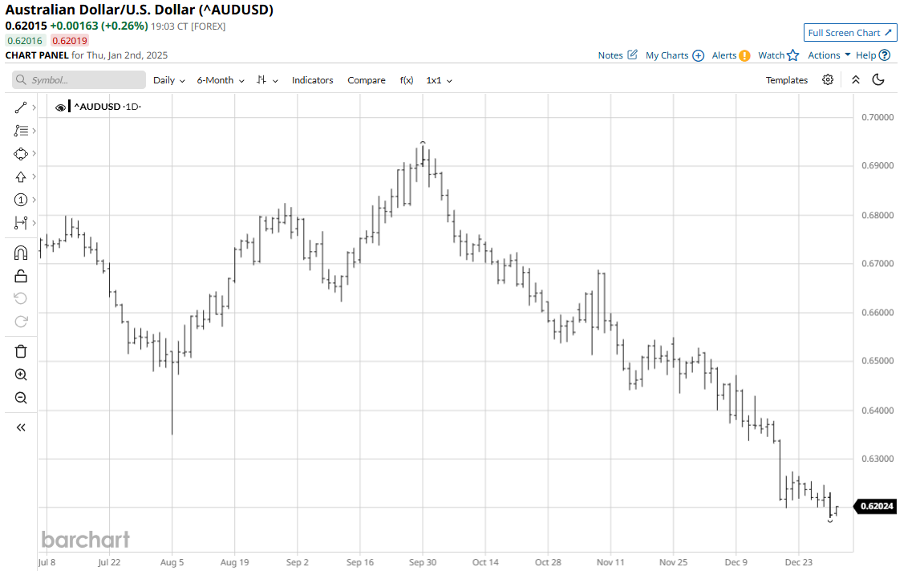

Australian grain prices have increased since the start of the year. This has been led by weather concerns off-shore and uncertainty over restrictive trade policy. Weather concerns continue to persist in both the US and Russian wheat growing regions. Also, US tariffs and Russian export restrictions have buyers seeking alternative options. Both situations bode well for good Australian wheat demand. Locally, ABARES recently raised national winter wheat production to 34.1 million metric tonnes (MMT). A great outcome considering the challenges of the season for many.

Weather

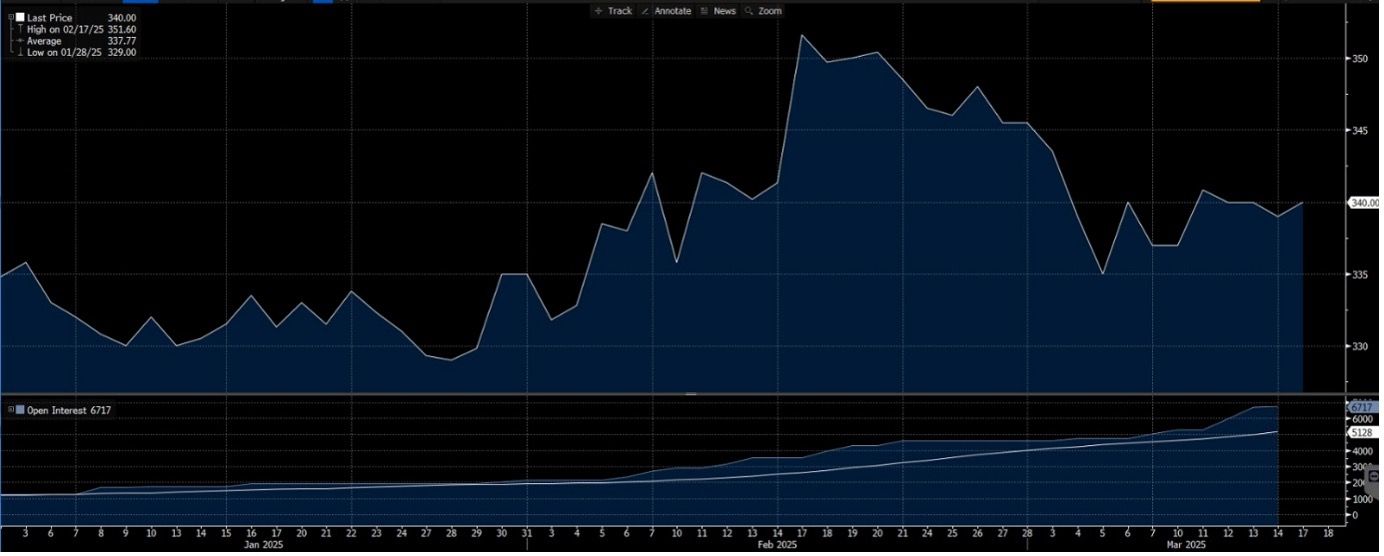

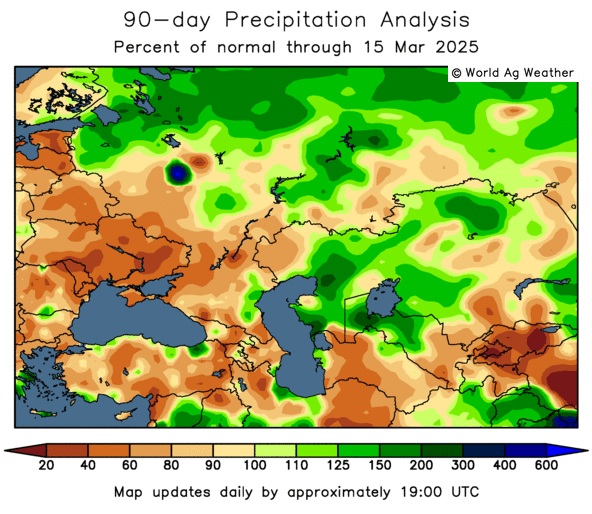

Russian wheat growing areas have been under some form of drought for the last 12 months. Currently, local analysts are predicting another low year of production due to decreased acres as a consequence of poor access to seed, inputs and labour. Although there was no serious winterkill event this season, a lack of winter rains may exacerbate this set up if spring rains do not perform. Ukraine has also had lower than normal rainfall over the last 90 days.

Unfortunately, southern, central and northern plains wheat growers of the United States are not experiencing much better weather for the start of their spring campaign. Associated Press reported on March 17th, that severe dust storms and wildfires were raging across much of Oklahoma and Texas impacting both croppers and livestock.

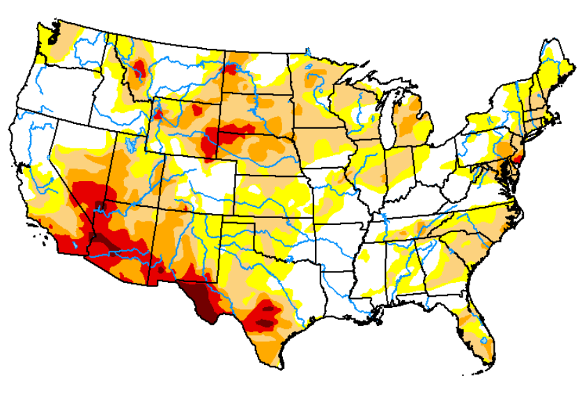

The US drought monitor shows that much of the northern plains is in moderate to severe drought. The south east of the country is experiencing even worse conditions as extreme and exceptional drought spread north and east from Mexico. The US Drought Monitor ranks drought in the following categories: D0 – abnormally dry, D1 – Moderate Drought, D2 – Severe Drought, D3 – Extreme Drought, D4 – Exceptional Drought.

A substantial pattern change will be required to avoid these drought conditions worsening at a time when winter wheat is exiting dormancy. March, April and May are the key periods for US winter wheat where moisture requirements will increase. This is presently not a good setup for spring.

Barriers to Trade

Russia has implemented a wheat export tax over the last several years to slow exports and dampen domestic inflation which is tracking at over 20% presently. Furthermore, late last year the government announced a plan to reduce export quotas by 50% for the first half of 2025 as they wait to see how the growing season performs for their new crop. The impact of this is to push demand to other producing origins such as Australia.

The Current US administration has implemented widespread tariffs in an effort to resolve a perceived unfairness in trade. At present, there is no evidence this will work and is more likely to add further costs into their own supply chain for US based producers and consumers. Whether this strategy works for them in the long term remains to be seen. In the short term, consumers will seek alternatives without trade barriers in place.

Export Pace

The start of the marketing season this year was dominated by exports of canola and pulses. Barley has also had a stronger than expected export pace this year. However, those programs are slowing down now which should free up room for wheat to take the lead. Logistical improvements combined with barriers to trade from the governments of other producing countries should see wheat exports improve.

ABARES update

The government statistics agency lifted Australian wheat production by 2.1MMT in their recent update to a national total of 34.1MMT. The states of Western Australia and New South Wales saw the increases. This is a strong outcome considering most regions experienced protracted periods of dryness or frost events (or both) during the last growing season. This shows the resilience and productivity of Australian producers. However, it is important to point out that many regions did not experience the required finishing weather and we hope their weather improves this autumn.

What does it all mean?

The normal weather-induced volatility one expects from the agricultural commodity markets is now exasperated by political intervention in multiple major countries. The price chart at the beginning of this report shows a $20 per metric tonne range in Australian wheat prices just in the first two and half months of the year. We expect this volatility to continue over the second quarter of 2025 as the northern hemisphere works through their weather issues in a key growing period. In the medium to longer term, global buyers will continue to “Buy Australian” as they can deal with a nation with less government intervention and more economic certainty.

The Advantage pooling programs help growers take the stress, guesswork and volatility out of grain marketing with a low risk structured marketing program. In volatile times such as this, a little less stress and risk is a good thing for everyone.

Email Newsletter Subscription

Email Subscription

We will get back to you as soon as possible.

Please try again later.

Other articles you may like

Contact Us

We will get back to you as soon as possible

Please try again later

Copyright © 2024 Advantage Grain Pty Ltd

site by mulcahymarketing.com.au